A message from Dr. Priya Sharma, Lead Manufacturing Engineer

The engineering team at PCB Express is constantly pushing the limits of what’s possible in manufacturing speed and precision to meet your demanding project timelines. That’s why I am incredibly excited to announce the launch of our new Rapid Prototyping Service Tier!

This new service isn’t a simple upgrade it’s a complete optimization designed for customers who must validate a design, test a new feature, or meet a critical deadline without ever compromising quality. By leveraging our Phoenix-based facility and rigorously optimizing our digital-to-physical workflow, we have dramatically reduced the fabrication timeline.

What This Means for Your Project Timeline

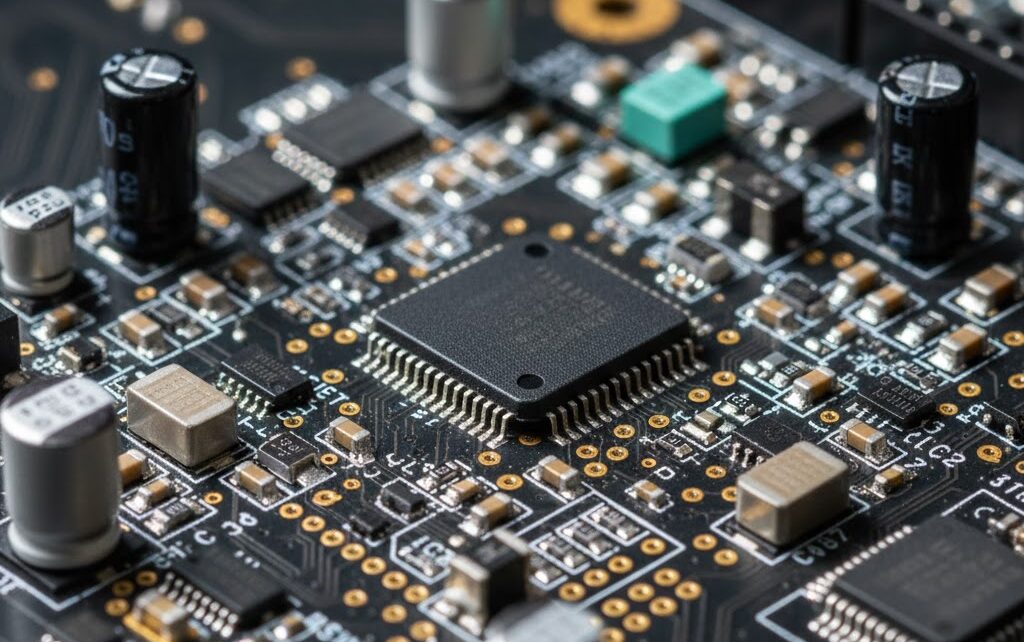

The Rapid Prototyping tier guarantees that standard 2-layer PCBs will be fabricated and ready to ship within an incredible 72 hours of receiving your confirmed order files. This speed is a game-changer, built on three essential operational pillars:

- Optimized Digital Vetting: Our proprietary software instantly reviews your design files (Gerbers, Drill Files, etc.) for manufacturability, virtually eliminating the slow human review process that creates drag in other shops.

- Dedicated Production Lane: Rapid Prototyping orders enter a dedicated, prioritized pipeline on our fabrication floor. This ensures continuous motion and minimal time loss between critical production steps, from etching and plating to final quality control and testing.

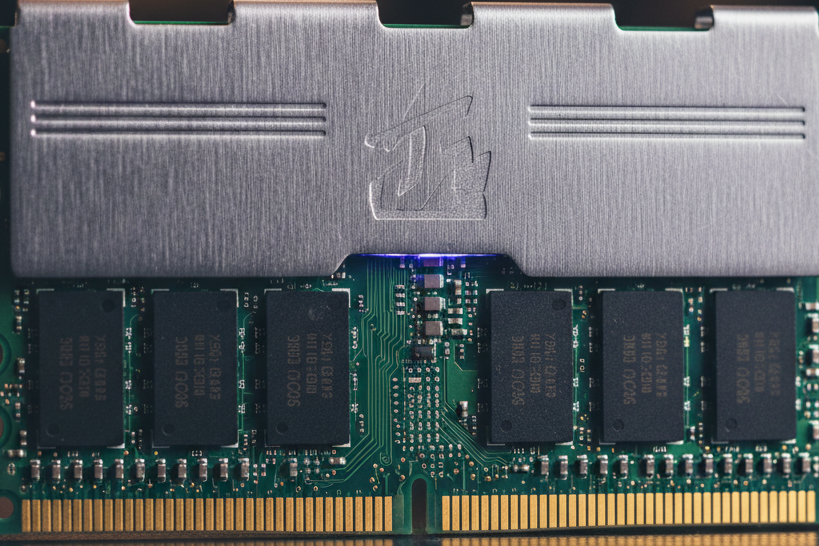

- Component Integration: As a component retailer ourselves, we maintain a robust inventory of standard parts. This minimizes reliance on external sourcing, eliminating one of the biggest bottlenecks when time is your enemy.

This new tier is the ideal solution for competitive hackathons, crucial university projects, or time-sensitive startup validation phases. It is the ultimate manifestation of our commitment to be your best partner in electronics innovation by delivering unparalleled speed and confidence exactly when your project demands it. Head over to our quoting page today and select the Rapid Prototyping tier we’re ready to bring your designs to life faster than ever before.